After two Marysville School District’s levies were rejected in the February special election, the district plans to try again with two reduced levy proposals.

On Feb. 23 the district’s Board of Directors approved the two proposals that were prepared by staff.

The two new proposals will be on the April 26 special election ballot.

Both levies are meant to renew formerly passed funding measures that will expire at the end of the 2022.

The Educational Programs and Operations levy (EPO levy) funds additional teacher positions, sports and extra-curriculars, nurses, transportation, counselors and a number of other district items.

Currently the district collects $2.50 per $1,000 of assessed property value for the measure and proposed a reduced rate of $2.20 per $1,000 of property value in the rejected measure in February.

The Board of Directors reduced the tax request again for their second proposal, which will move the rate down to $1.97 per $1,000 of property value.

The second levy is a Technology and Capital Projects levy which will provide money for school facility maintenance and technology purchases for students.

“We’re reducing that levy considerably,” said David Cram, executive director of finance for the district.

The district collects $0.60 per $1,000 property value for the measure right now, which is the amount they proposed to continue in February.

The current request will bring that down to $0.26 per $1,000 of property value.

“That is a combined $0.87 per $1,000 savings of what they’re currently paying on their levies,” said Cram.

School board directors and district staff came to the proposals after a community survey.

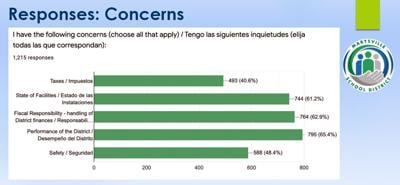

Parents and school staff said their biggest concerns were the performance of the district, fiscal responsibility and the state of facilities.

All of those answers received more than 60 percent agreement.

About 40.6 percent of respondents said the tax rate was one of their primary concerns.

A second question asked if a lowered tax rate would impact your decision on a levy vote and about 64 percent responded ‘no.’

“It doesn’t appear that the tax rate was the most significant factor about whether people voted yes or no, it was these other things like transparency,” said Marysville School District Superintendent Chris Pearson.

Pearson said the district needs to be better at explaining to the public what they’re voting for.

“There were concerns and misunderstandings related to increases in property taxes and use of levy dollars,” he said.

The district hopes to begin weekly community roundtables to get the message out.

“So, with approval, starting next Wednesday we will begin hosting round tables at two different schools each week,” said Pearson. “We’ll do school tours so they can come out and see our facilities."

Without the EPO levy the district would be looking at a budget shortfall of about $13.5 million in the spring of 2023 and about $12.2 million in the fall of that year.

That would likely mean hundreds of stipends for club activities, reductions in support staff for the athletic departments, security staff reductions, less bus runs and reductions of administrative and teaching staff.

Canceling some sports seasons would have to be considered.

“It’s pretty significant when you’re trying to reduce $13 million,” said Cram.

Even if the levy does pass, the district will have to figure out some cuts going forward.

“We’ll still be looking at a reduction of about $1.5 million dollars in our next budget cycle and $1.3 million the year after,” said Cram.

The technology and capital project levy will create a shortfall as well, of about $2.1 million in early 2023 and $1.9 million the next school year.

The school district could potentially sell some of their unused land to make up the difference for that levy, said Cram.

The passing of the two levy proposals would not preclude later levy increase proposals.

“That does not mean we couldn’t go out in year three or four for a new levy or a levy increase,” said Cram.

A district can only propose a levy two times in a year, so the April 26 ballot is the final opportunity this year for the district to approve these levies.

(0) comments

Welcome to the discussion.

Log In

Keep it Clean. Please avoid obscene, vulgar, lewd, racist or sexually-oriented language.

PLEASE TURN OFF YOUR CAPS LOCK.

Don't Threaten. Threats of harming another person will not be tolerated.

Be Truthful. Don't knowingly lie about anyone or anything.

Be Nice. No racism, sexism or any sort of -ism that is degrading to another person.

Be Proactive. Use the 'Report' link on each comment to let us know of abusive posts.

Share with Us. We'd love to hear eyewitness accounts, the history behind an article.